dependent care fsa limit 2021

If a child turned 13 in the 2020 plan year AND the participant rolled over funds into. Employers may allow participants to carry over unused amounts IR-2021-40 February 18 2021 WASHINGTON The Internal Revenue Service today provided greater flexibility due to the pandemic to employee benefit plans offering health flexible spending arrangements FSAs or dependent care assistance programs.

Pin By David K Blanton Cpa Pllc On For Work Cpa Accounting Income Tax Preparation Accounting Firms

But a new bill from Congress passed last week and is changing that.

. WASHINGTON The Internal Revenue Service today issued guidance on the taxability of dependent care assistance programs for 2021 and 2022 clarifying that amounts attributable to carryovers or an extended period for incurring claims generally are not taxable. The run-out period for filing claims for the 2019 Plan Year for healthcare limited- purpose and dependent care FSA plans has been extended. 10500 On March 11 2021 The American Rescue Plan Act of 2021 ARPA was signed into law by President Biden.

The American Rescue Plan Act of 2021 has affected both continuation coverage and the limit for dependent care FSAs. The increase in the DCFSA contribution limit is optional. HSA limits for 2021 have increased to 3600 for self-only coverage or 7200 for family.

Amount of unused funds members can carry over into Plan Year 2021. One of the provisions included in ARPA temporarily increased the limits on dependent care FSAs for 2021. Now single filers can contribute up to 5250 increased from 2500 and married couples filing jointly can contribute up to 10500 increased from 5000.

In 2021 the Dependent Care FSA limit was increased to 10500 for single taxpayers and married couples filing jointly and to 5250 for married individuals filing separately. The Dependent Care FSA DCFSA can be offered alongside the standard medical FSA or as a stand-alone enhancement to help cover the eligible child or adult care expenses that are not covered or reimbursed by your other pre-tax accounts. For calendar year 2021 the dependent care flexible spending account FSA pretax contribution limit increases to 10500 up from 5000 for single taxpayers and married couples filing jointly.

1 Dependent Care FSA limit for 2021 - 10500 03-23-2021 0551 AM just wanted to make you aware. ARPA Dependent Care FSA Increase Overview ARPA increased the dependent care FSA limit for calendar year 2021 to 10500. Dependent care FSA increase to 10500 annual limit for 2021.

The new Dependent Care FSA annual limit for 2021 pretax contributions increases to 10500 up from 5000 for single taxpayers and married couples filing jointly and to 5250 up from 2500 for married individuals filing separately. What is the 2021 Dependent Care limit. The Consolidated Appropriations Act of 2021 allows some Dependent Care FSA plan participants to file claims for their eligible dependent care expenses for children through the end of the plan year in which the child turns 13 rather than the standard IRS provision of only to the 13th birthday.

On March 11 2021 The American Rescue Plan Act of 2021 ARPA was signed into law by President Biden. Health FSA limits remain unchanged. Dependent Care FSA Limit increased to 10500 from 5000 for married couples.

The American Rescue Plan President Joe Biden s 19 trillion stimulus package boosted child-care assistance through temporary changes to dependent-care FSAs. The date is extended through the 60th day after the end of the federal public health emergency. To offset a portion of the high cost of childcare consider a Dependent Care Flexible Spending Accounts DCFSA and the Dependent Care Tax Credit.

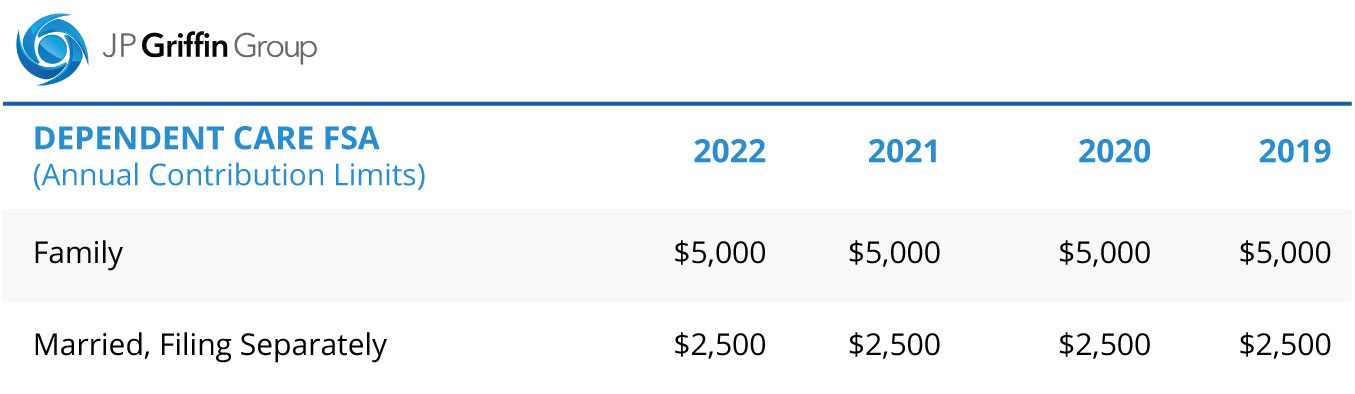

The Dependent Care FSA DCFSA maximum annual contribution limit did not change for 2022. This was part of the American Rescue Plan. Typically if you dont spend your Dependent Care FSA funds by the end of the year you lose that money.

ARPA allows employers to increase the annual limit on contributions to dependent care FSAs up to 10500 for the 2021 plan year only. On March 16 2021 The limit for dependent care flexible spending accounts has been stuck at 5000 since the accounts inception in the 1980s. You can use your DCFSA dollars on a wide variety of child and adult care services.

The American Rescue Plan Act of 2021 includes an optional but not required temporary change for the calendar year of 2021 to increase the maximum pretax contribution limit from 5000 Read more. Remember you must have a qualifying high deductible health plan HDHP to be eligible for an HSA. ARPA automatically sunsets the increased dependent care FSA limit at the end of 2021.

The law increased 2021. As part of the recent legislation American Rescue Plan Act. The guidance also illustrates the interaction of this standard with the one-year increase in the.

The minimum annual election for each FSA remains unchanged at 100. What is the limit for dependent care FSA. The dependent care FSA contribution limit will remain at 5000 for 2021.

As with the standard rules the limit is reduced to half of that amount 5250 for married individuals filing separately. What is the 2021 HSA contribution limit. This is an increase of 100 from the 2021 contribution limits.

Adviser Danielle Harrison explains what. It remains at 5000 per household or 2500 if married filing separately. For 2021 only the DCFSA contribution limit for qualifying dependent care expenses is increased from 5000 to 10500 for individuals or married couples filing jointly and from 2500 to 5250 for married individuals filing separately.

ARPA allows employers to increase the annual limit on contributions to dependent care FSAs up to 10500 for the 2021 plan year only.

Finally Additional Relief For Dependent Care Assistance Programs Due To Covid 19 Word On Benefits

Dependent Care Fsa Outdoor Activities For Kids Free Things To Do Kids Pictures

What Is A Dependent Care Fsa Wex Inc

Explore Our Free Grocery Store Receipt Template Receipt Template How To Get Money Receipt

Are Virtual Day Camps And Daycare Eligible Under A Dependent Care Fsa Vita Companies

Browse Our Image Of Itemized Restaurant Receipt Template Receipt Template Templates Words

What Is A Dependent Care Fsa Wex Inc

Explore Our Sample Of Child Care Expense Receipt Template Receipt Template Child Care Services Receipt

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

Dependent Care Accounts And The Taxation Of Carryover Amounts Word On Benefits

2021 Year Planner Hra Consulting Photo Yearly Planner Calendar Examples Planner

Browse Our Image Of Itemized Restaurant Receipt Template Receipt Template Templates Words

Receipts For Child Care 2 Per Page Daycare Home Daycare Starting A Daycare

What Is A Dependent Care Fsa How Does It Work Ask Gusto

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

Using A Dependent Care Fsa To Reimburse Childcare Costs In 2022

How The American Rescue Plan Act Of 2021 Impacts Dependent Care Assistance Programs Word On Benefits